Please jump right into the Big View bullets and weekly video. Due to travel there will not be Outlook commentary be released later today.

Summary: While Friday’s action was encouraging for a nascent market turnaround, we need to see further confirmation, like the Nasdaq and S&P regaining their 200-Day moving averages. Value stocks continue to outperform and seem to be poised to lead the market up or outperform on a further decline, although Semiconductors could also signal a reversal in the beaten down tech sector and a return to risk-on.

Risk On

- Markets hit new recent lows on Thursday and were oversold on price and Real Motion and were setup for mean reversion trades across the four key indexes. We got a strong bounce on Friday. We need further confirmation that this wasn’t just a short-term relief rally. (+)

- The number of stocks above their key moving averages hit oversold levels and are already starting to reverse, particularly on the 20-Day Moving Average. (+)

- Value stocks improved into a strong warning phase this week. (+)

- BTC has effectively held its 200-Day Moving Average, going back several years. It tested that average and recovered nicely. (+)

- Seasonal trends are confirming a potential bounce in the latter half of March aligning with many other mean-reversion signals and could indicate a particularly strong bounce. (+)

Neutral

- Risk-off sectors like Gold Miners and Utilities were up on the week. However, semiconductors were also up, which if it holds up, could translate to a more significant tech rally.(=)

- Volume patterns are still very weak, though marginally improved from recent levels. (=)

- Even though the McClellan Oscilator is still in negative territory, it has leveled off and bounced from oversold levels. (=)

- The new high new low ratio on the Nasdaq is potentially basing out at low levels that could support a mean reversion bounce. (=)

- The SPY color charts (moving average of the percentage of stocks above key moving averages) shows neutral readings on a short-to-midterm basis (=)

- As we noted last week, Volatility measurements hit overbought levels and is in the process of mean reverting from key resistance levels in both the cash and futures-based ETF. (=)

- Foreign equities continued to outperform U.S. equities by some of the widest margins in quite some time. (=)

- All of the modern family members are trading under their 200-Day Moving Average. Semiconductors are now slightly outperforming the S&P on a short-term basis, which could be a lead indicator of whether we are going to enter a more risk-on environment. (=)

Risk Off

- Latin american equities were strong this week, likely related to commodities, especially metals, Silver, Gold and Copper. (-)

- The Nasdaq and IWM color charts (moving average of the percentage of stocks above key moving averages) continues to give negative readings across the board. (-)

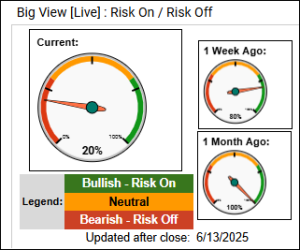

- Risk gauges remain fully risk-off despite Friday’s bounce. (-)

- Gold bucked the trend and put in new all-time highs, which is consistent in a risk-off environment as we have pointed out in the past. Equities can go up against this trend, but one usually accedes to the other. (-)

- The dollar remains under pressure and was marginally down on the week. Considering the importance of the dollar in global finance, and declining equities, this is a negative. (-)